What are Forensic Accountants and How Do They Uncover Financial Fraud?

Forensic accountants are commonly known as the detectives of the financial world. Their task is to sift through the numerical and financial complexities, employing their profound knowledge in accounting, auditing, and investigative skills to detect unusual financial patterns and discrepancies that could be indicative of fraudulent activities.

However, the scope of a forensic accountant's role is not merely confined to the identification of financial fraud. They also participate in litigation support, providing expert testimony in court, and investigative auditing. But what does the process of uncovering financial fraud by a forensic accountant look like?

In the realm of forensic accounting, the process starts with a deep understanding and analysis of financial data, which is often voluminous and complex. This data is typically gathered from several sources, including but not limited to, financial statements, bank statements, invoices, contracts, and tax returns, among others.

Forensic accountants utilize various analytical techniques such as horizontal and vertical analysis, ratio analysis, and trend analysis to identify anomalies in financial data. Horizontal analysis involves comparing financial data over a period of time, whereas vertical analysis involves comparing each item on a particular statement with a total figure from that statement. Ratio analysis is used to assess the financial stability, profitability, and liquidity of a business, while trend analysis involves examining the financial statements of a business over different periods.

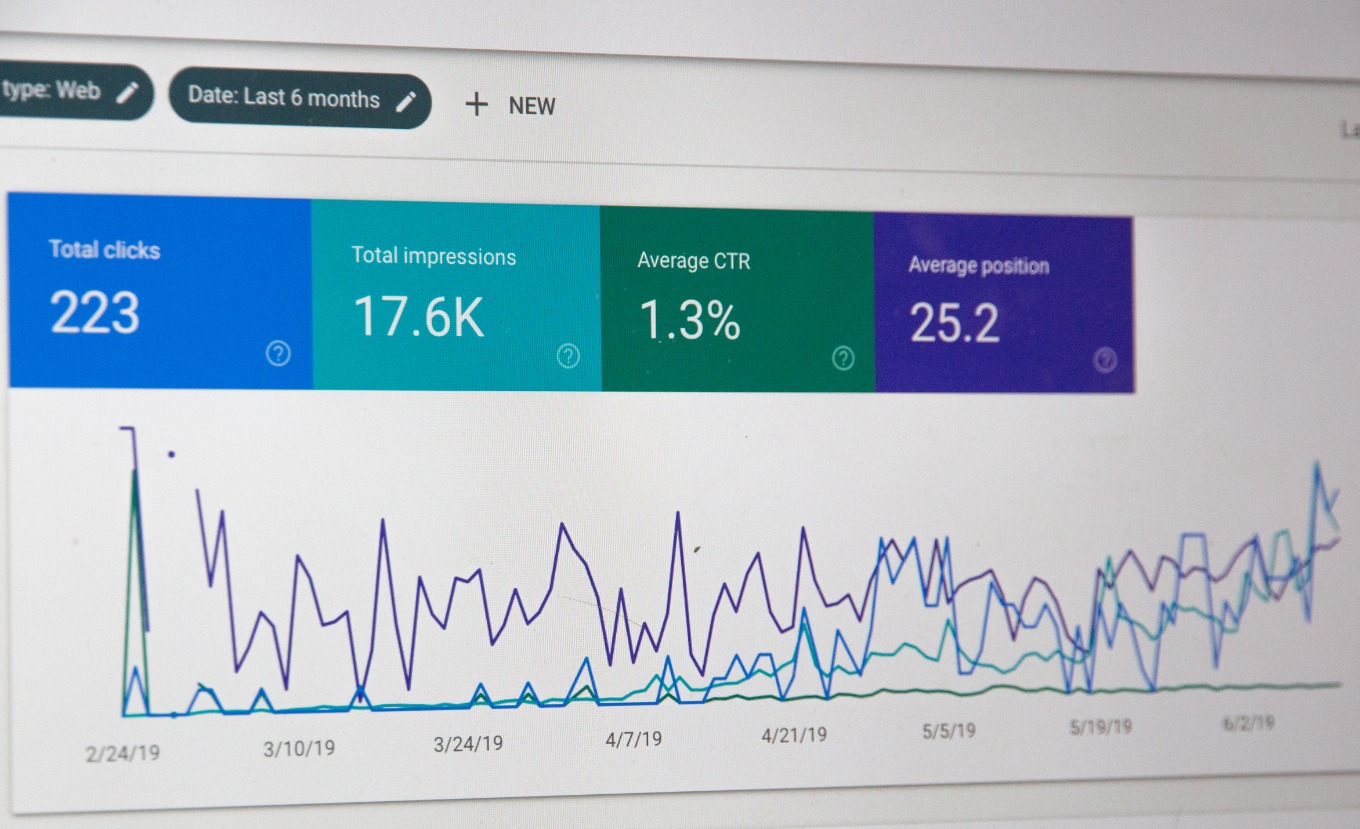

Let’s delve a little deeper into, say, horizontal analysis. When assessing a company's direct expenses over the past five years, if a forensic accountant notices a sudden, unexplained spike in the expense in one particular year, it could potentially be a red flag for financial fraud.

In addition to these techniques, forensic accountants also employ data analytics tools and software to scrutinize large datasets. Technological advancements have resulted in the development of sophisticated software capable of performing complex computations and analyses. These tools aid in the identification of patterns and correlations within data, which might be virtually impossible to detect manually.

After the analysis, the forensic accountant prepares a detailed report outlining the findings. If fraudulent activity is suspected, this report may serve as crucial evidence in court, supporting the case of the prosecution or defense. It’s not uncommon for a forensic accountant to provide expert testimony in court, presenting the findings of the investigation in a manner that is comprehensive and comprehensible to the judge and jury.

Now, one might wonder, why go through all this trouble? Why do we need forensic accountants? The answer is simple yet profound. Financial fraud is a menace that has the potential to destabilize economies, erode investor confidence, and destroy businesses. It’s not just the direct financial loss; the indirect ramifications, such as reputational damage, can be even more detrimental for an organization.

Moreover, financial fraud is often intricate and camouflaged with layers of fictitious transactions and manipulations. Traditional auditing often fails to uncover these sophisticated fraud schemes. This is where the specialized skills and expertise of forensic accountants come into play, providing an extra layer of defense against financial fraud.

In conclusion, forensic accountants are financial detectives, employing their expertise in accounting, auditing, and investigation to detect and prevent financial fraud. They play a pivotal role in maintaining the integrity of financial systems, thereby contributing significantly to the economic well-being of societies. It's a high-stakes game of cat and mouse, and in this instance, the forensic accountants are the felines, constantly evolving to keep pace with the ever-innovative rodents of financial fraud.

Forensic accountants are commonly known as the detectives of the financial world, employing their profound knowledge in accounting, auditing, and investigative skills to detect unusual financial patterns and discrepancies that could be indicative of fraudulent activities.